Executive Summary (TL;DR)

Financial institutions across the United States and Canada channel $61 billion each year into financial-crime and regulatory-compliance programs, yet non-compliance fines still land at 2.7× the cost of simply staying compliant (USA $42 B, Canada $19 B).¹ ²

The AI Financial Contract Compliance Checker steps in as a SaaS gatekeeper: it ingests loan agreements and investment contracts, flags clauses that violate Securities and Exchange Commission (SEC), Office of the Comptroller of the Currency (OCC), or Anti-Money Laundering (AML) rules, and recommends fixes before execution. Early pilots point to a 20–30 % cut in contract-review hours and a 15 % drop in regulatory findings, achieving ROI within 9–12 months.

Problem / Opportunity

- North-American firms spend $61 B annually on compliance, yet face relentless rule changes (SEC slated 24 new rules in 2023 alone).¹ ³

- Regulatory churn is relentless: in 2024, financial institutions were hit with ≈ 661 new or amended regulatory alerts every business day—over 240 000 notices for the year (Wolters Kluwer Regulatory Change Outlook 2024), a 12 % YoY increase that outstrips the capacity of manual tracking teams.

- Average cost of a single non-compliance event: $14.8 M versus $5.5 M to maintain compliance — a 2.7× penalty premium (median settlement across 2020–2023 AML/SEC actions).² ⁴

- Global compliance workload grew 61 % in staff hours between 2016 and 2023, stretching legal teams and throttling deal velocity.²

Solution Overview

- Context-aware NLP pipeline extracts covenants, collateral descriptions, and jurisdictional data, mapping each to current regulations.

- Rules + Retrieval-Augmented Generation (RAG) engine cross-checks SEC, OCC, Financial Industry Regulatory Authority (FINRA) bulletins, and AML/KYC guidance in real time.

- Legal-analyst cockpit highlights risky clauses with citation links and severity scores; offers one-click rewrite suggestions.

- REST and GraphQL APIs drop into document-management systems (iManage, SharePoint) and loan-origination platforms.

- Continuous learning loop retrains on regulator feedback and internal-audit outcomes to keep precision climbing.

Technical Approach

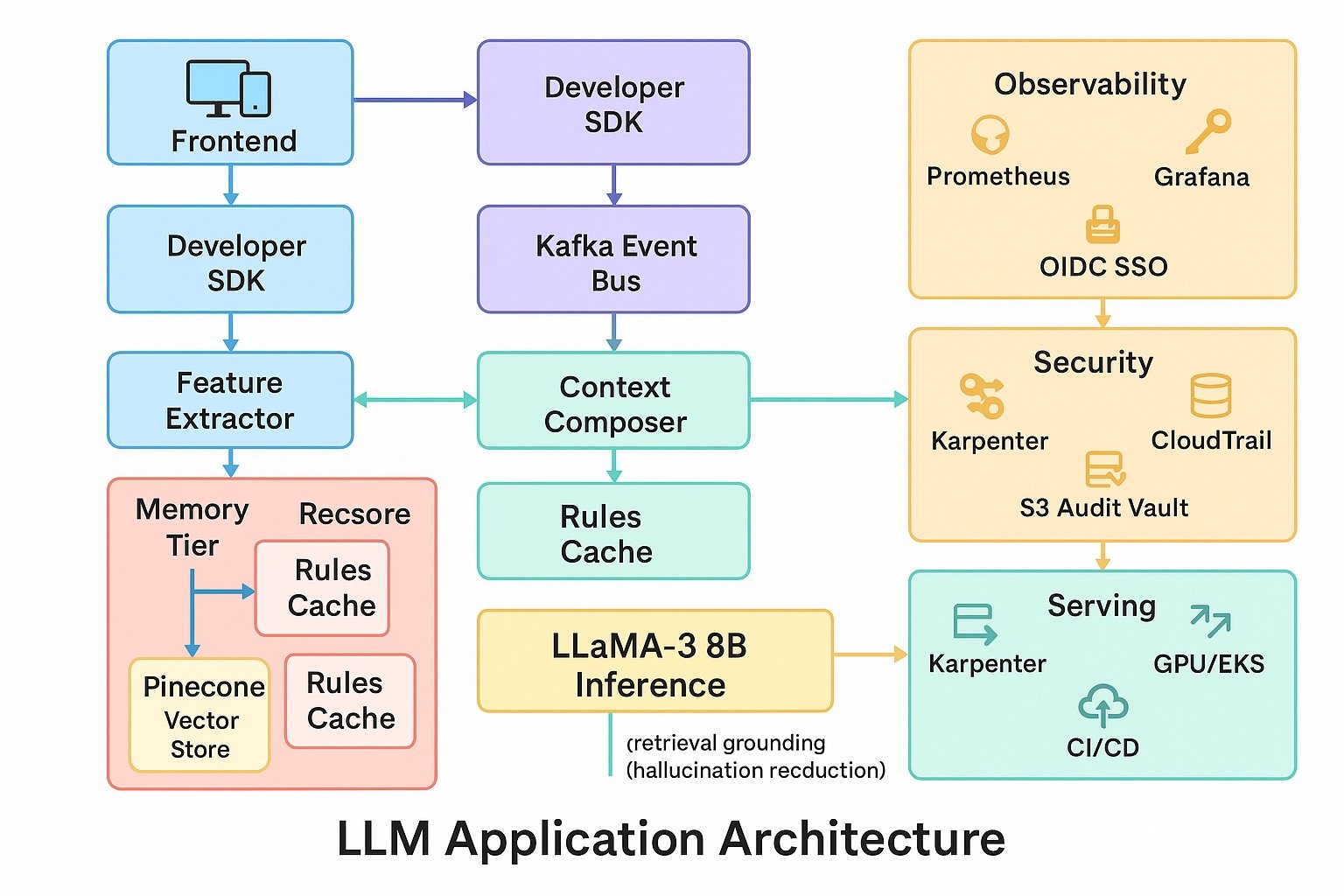

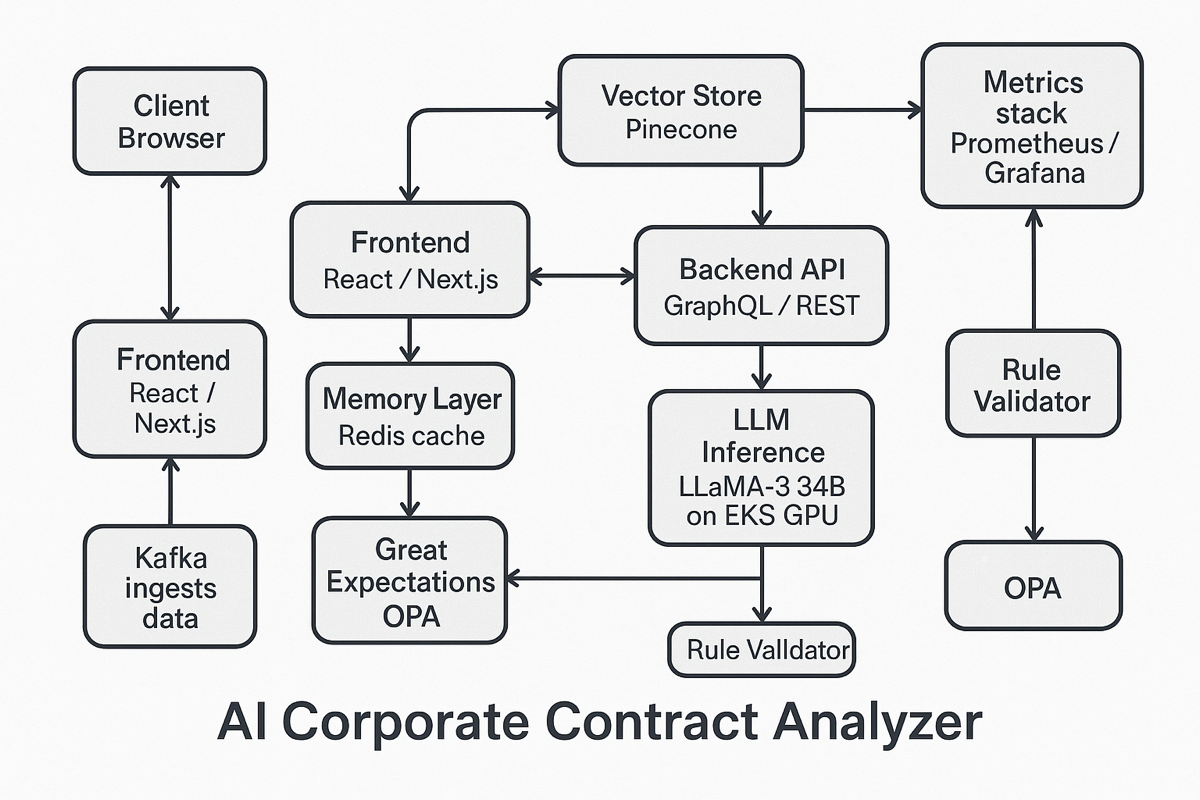

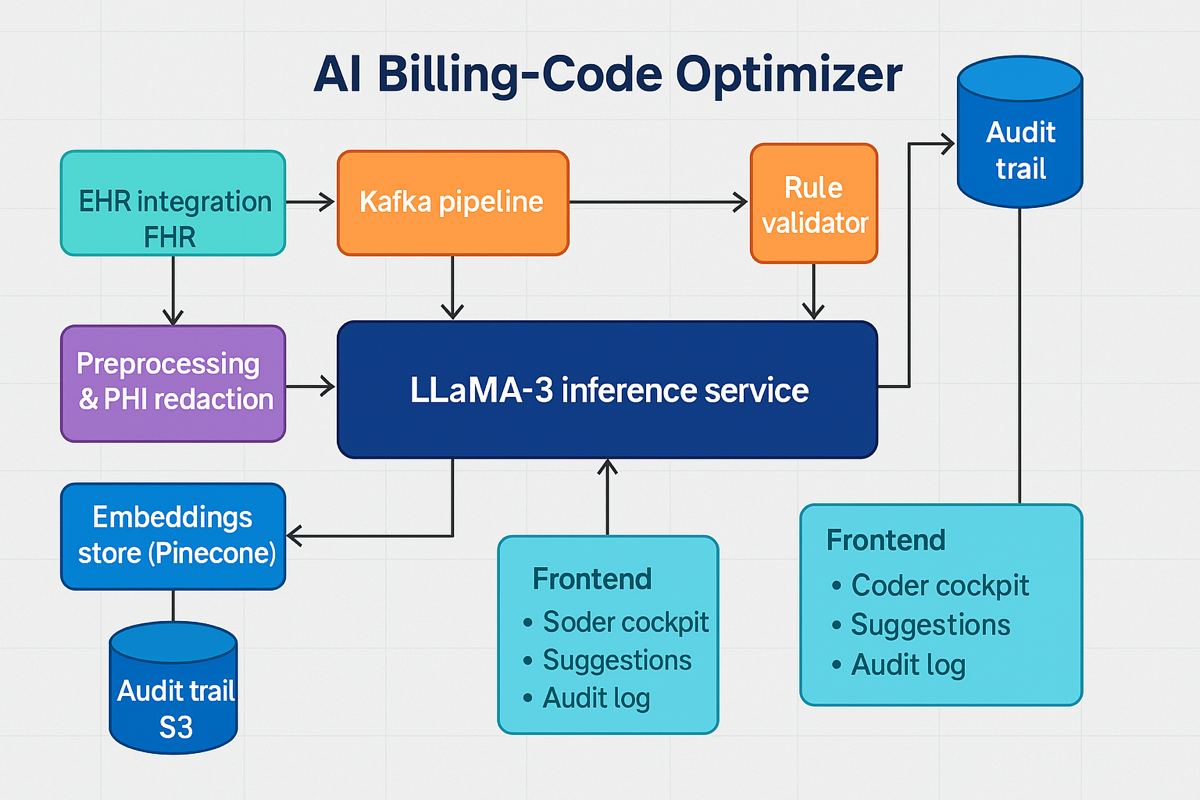

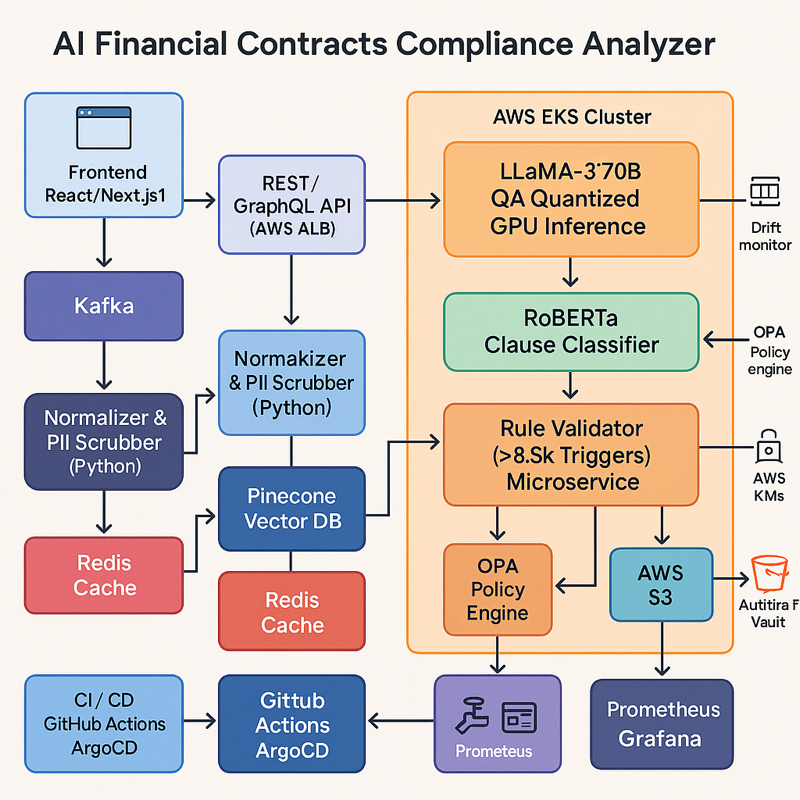

- Model stack. Fine-tuned LLaMA-3 70B-Q4 quantized with finance-law adapters; supplementary RoBERTa-based clause classifier; rule-based validator encoding ≈ 8500

regulatory triggers (AML, Basel III, SEC Reg S-K). - Knowledge & retrieval. Hybrid vector + keyword search (Pinecone) across SEC rule texts, OCC bulletins, FINRA notices, and International Swaps and Derivatives Association (ISDA) templates; embeddings via open-source BGE-Large; LangChain orchestrates retrieval and prompt assembly.

- Data pipeline. Real-time ingestion from loan-origination and document repositories; Apache Kafka streams → text normaliser → embedding → inference. Great Expectations enforces schema and strips Personally Identifiable Information (PII).

- Serving & infra. GPU-backed Amazon Web Services Elastic Kubernetes Service (AWS EKS) with auto-scaling; Weights & Biases monitors drift; deployed on AWS GovCloud with Key Management Service (KMS) encryption, Virtual Private Cloud (VPC) isolation, and SOC 2 compliance; blue-green Continuous Integration / Continuous Deployment (CI/CD) via GitHub Actions + ArgoCD.

- Security & audit. OAuth 2.0 / OpenID Connect (OIDC) single sign-on; AWS CloudTrail logs every inference; immutable Amazon S3 audit store (7-year retention); Open Policy Agent (OPA) guards runtime access.

- Front-end & UX. React/Next.js with Tailwind; WebSocket stream for sub-second clause feedback; role-based dashboards for counsel, compliance, and risk teams; Figma design system meets Web Content Accessibility Guidelines (WCAG) 2.1 AA.

- Observability. Prometheus + Grafana dashboards (latency, throughput, GPU utilisation); Sentry for front-end errors; PagerDuty on SLA breach. SAR (Suspicious Activity Report) feedback loop for continual learning.

Business Metrics (Targets)

| KPI | Target | Notes |

| Contract-review hours saved | 20–30 % | Versus manual baseline |

| Regulatory findings (audit hits) | ≥ 15 % reduction | Based on pilot benchmarks |

| Platform adoption (analyst DAU) | 50 % by Month 3 | Staggered rollout across legal teams |

| Client satisfaction | CSAT ≥ 4.6 / 5 | Quarterly survey of compliance officers |

Product Metrics (Targets)

- Clause-risk F1 ≥ 0.91

- Median latency ≤ 1.2 s

- Uptime ≥ 99.7 %

- False-positive rate ≤ 12 %

Expected Impact

For a mid-tier bank spending $5.5 M on compliance annually, a 25 % efficiency gain plus fewer findings unlocks ≈ $1.4 M in savings, while reducing multi-million-dollar enforcement penalties and accelerating deal-closure times. With Year-1 subscription of $750 k, net savings yield payback in 6.5 months.Median SEC/AML fines hit $8.4 M in 2023; trimming even 15 % avoids ≈ $1.3 M per violation.

Reference URLs (raw)

- True Cost of Compliance US & Canada 2024 — LexisNexis Risk Solutions

https://risk.lexisnexis.com/about-us/press-room/press-release/20240221-true-cost-of-compliance-us-ca - The Not-So-Hidden Costs of Compliance — Ascent RegTech

https://www.ascentregtech.com/blog/the-not-so-hidden-costs-of-compliance/ - SEC Plans to Finalize Two Dozen Rules in 2023 — Thomson Reuters Tax & Accounting News

https://tax.thomsonreuters.com/news/sec-plans-to-finalize-two-dozen-rules-in-2023/ - Cost of Non-Compliance: 14.8 M Average Event — Colligo

https://www.colligo.com/cost-of-non-compliance/ - Global Regulatory Change Outlook 2024 — Wolters Kluwer

https://www.wolterskluwer.com/en/expert-insights/regchange-outlook-2024 - 2023 AML & Sanctions Penalty Report — Fenergo

https://fenergo.com/resources/research-reports/global-fines-report-2023/

OFAC Consolidated Sanctions List (download) — U.S. Treasury

https://home.treasury.gov/policy-issues/financial-sanctions/consolidated-sanctions-list