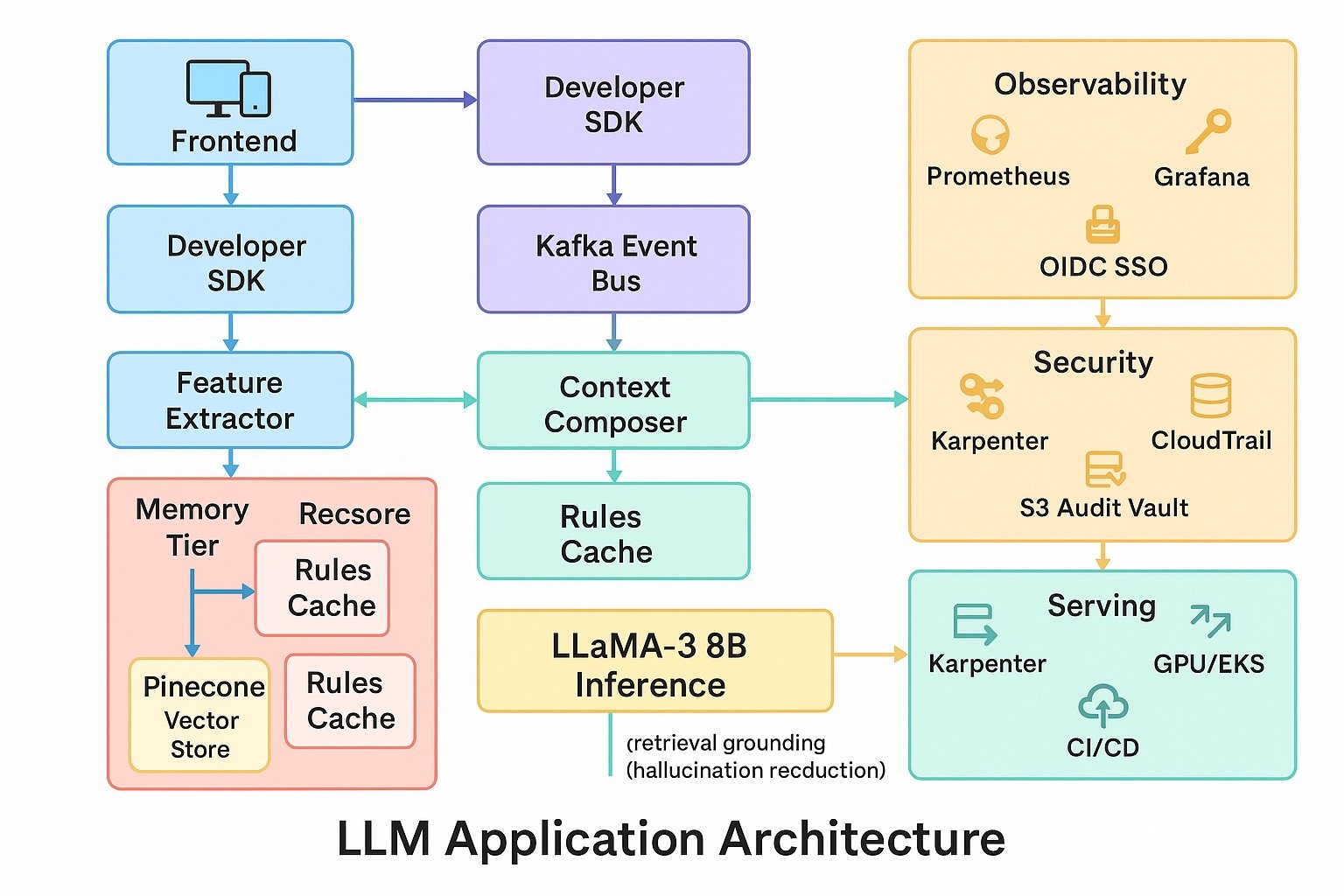

Executive Summary (TL;DR) Generic large-language-model (LLM) sessions forget everything at the end of each prompt, forcing users to retransmit context and burning tokens.¹ Personalization layers exist today via Retrieval-Augmented Generation (RAG), which queries an external vector database on every turn—incurring ≥ 200 ms network latency and extra cost per call.² Cache-Augmented Generation (CAG) stores high-value […]

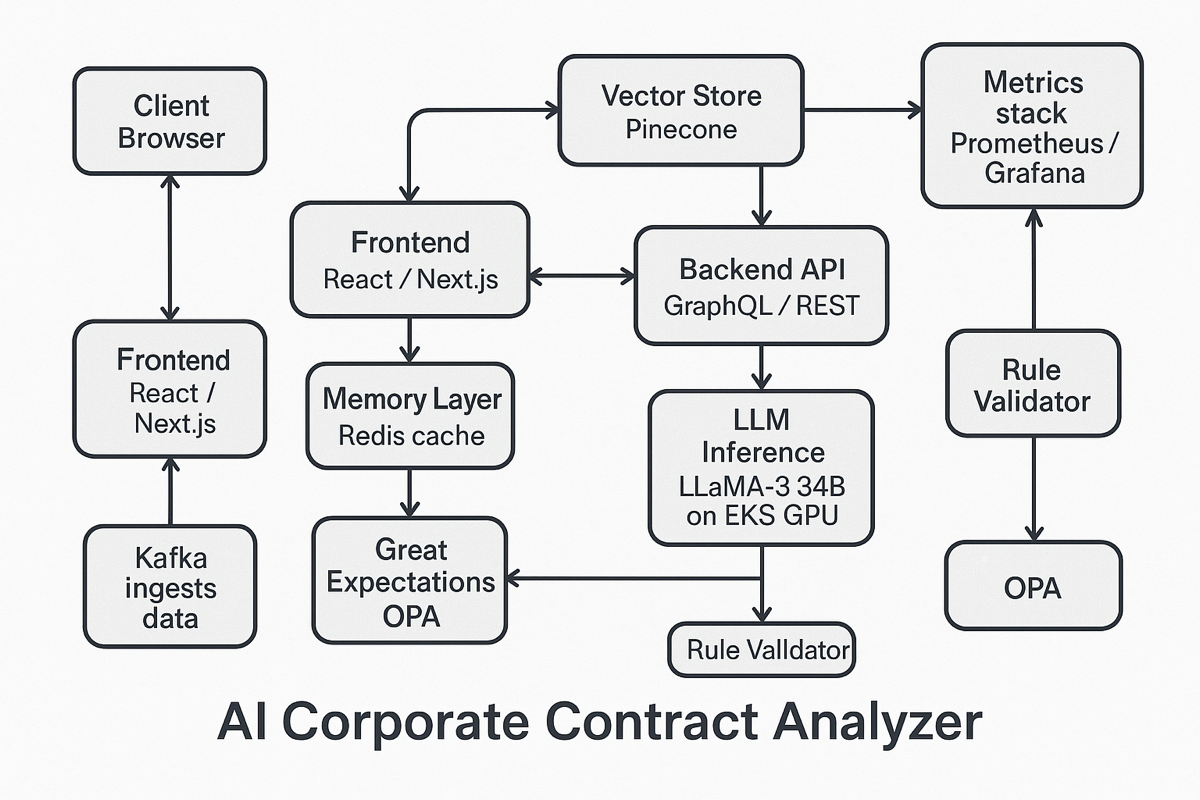

Executive Summary (TL;DR) Poor contracting siphons ≈ 9 % of annual revenue from companies worldwide, mostly via missed obligations and hidden risk. Corporate counsel now face review fees ranging $250–$350 per hour—spikes to $2,500 at elite firms—just to keep up. The AI Corporate Contract Analyzer ingests vendor, employment, and partnership agreements, flags risky clauses, and […]

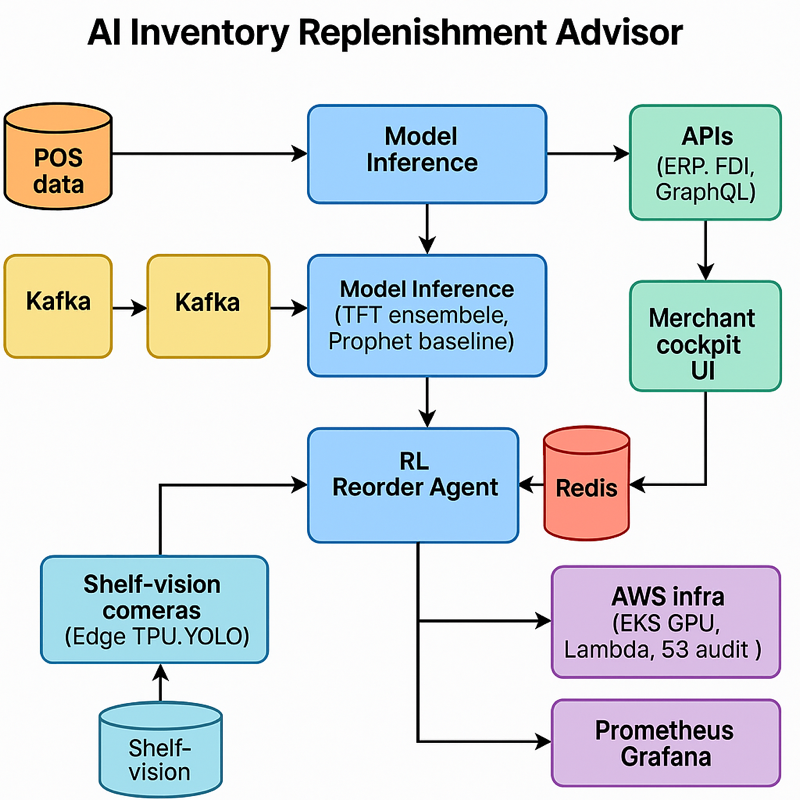

LAST UPDATE DATE: Mar 19, 2025 Executive Summary (TL;DR) Inventory distortion—out-of-stocks and overstocks—bleeds $1.77 trillion from global retailers every year. In North America alone, out-of-stock items siphon 5.9 % of grocery sales and fuel costly brand erosion (NielsenIQ OSA Benchmark, 2021). The AI Inventory Replenishment Advisor embeds in merchandising systems, predicts demand for perishables and […]

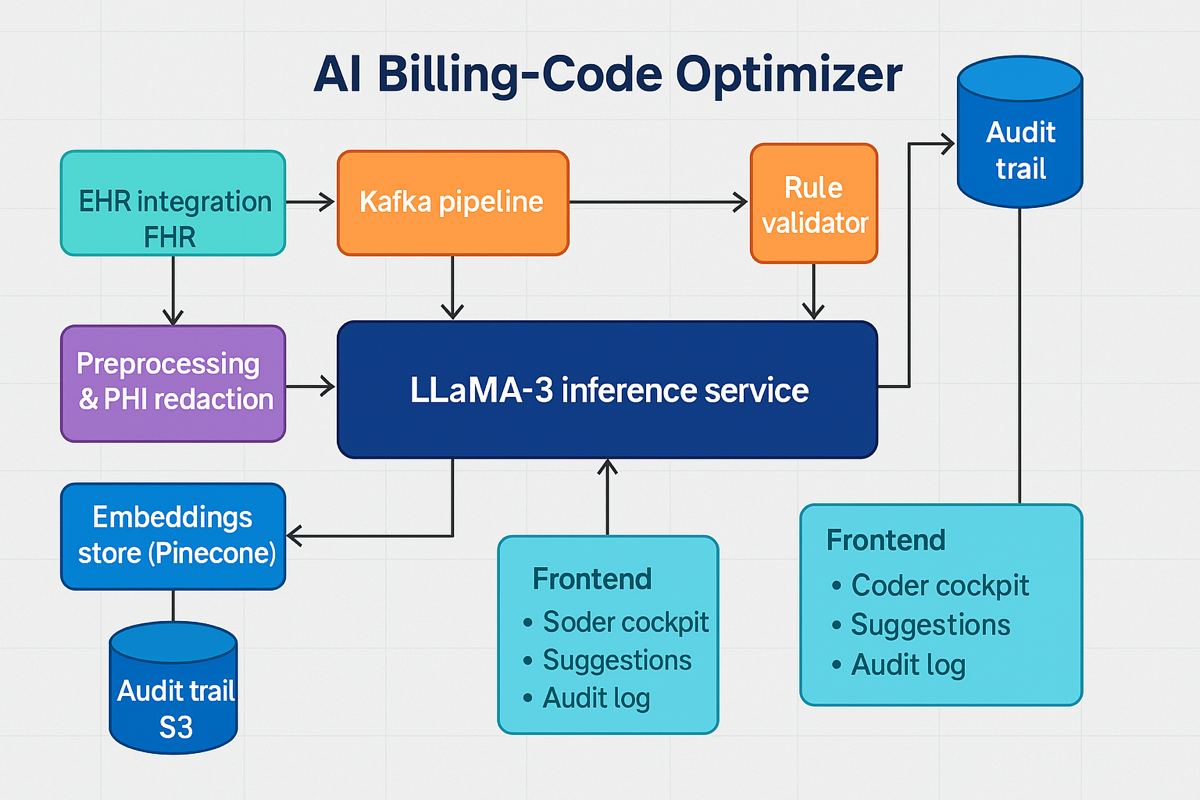

Executive Summary (TL;DR) U.S. hospitals spend $19.7 billion a year on administrative appeals of denied claims (OIG 2023), while roughly 15 % of all initial claims are rejected (STAT 2024). Those denials jeopardise ≈ 3.3 % of net patient revenue (≈ $4.9 million per 250-bed facility). The AI Billing-Code Optimizer plugs into the Electronic Health […]

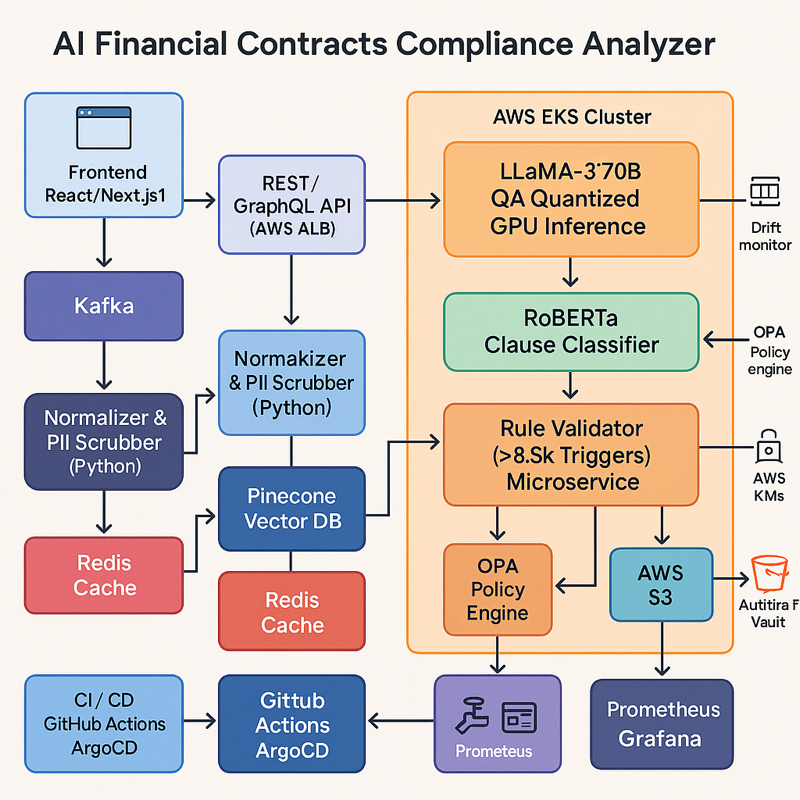

Financial institutions across the United States and Canada channel $61 billion each year into financial-crime and regulatory-compliance programs, yet non-compliance fines still land at 2.7× the cost of simply staying compliant (USA $42 B, Canada $19 B).¹ ²

The AI Financial Contract Compliance Checker steps in as a SaaS gatekeeper: it ingests loan agreements and investment contracts, flags clauses that violate Securities and Exchange Commission (SEC), Office of the Comptroller of the Currency (OCC), or Anti-Money Laundering (AML) rules, and recommends fixes before execution. Early pilots point to a 20–30 % cut in contract-review hours and a 15 % drop in regulatory findings, achieving ROI within 9–12 months.